Internal Audit Services in the UAE

In the dynamic business landscape of the United Arab Emirates (UAE), our Internal Audit Services play a vital role in ensuring transparency and efficiency. With a meticulous review of your organization’s financial and operational processes, we tailor our services to enhance your business’s financial health, mitigate risks, ensure compliance and optimize performance. Our dedicated team of professionals understands the uniqueness of each business, offering comprehensive internal audit solutions that align with UAE regulations and international best practices.

Optimize Efficiency and Compliance

Understanding the Role of Internal Auditing

Internal audit is the systematic evaluation of all aspects of an organization’s operations. This includes internal controls, regulatory compliance, corporate governance, and accounting processes, all conducted with the aim of enhancing the entity’s operations and adding value.

This service provides organizations with an impartial and independent review of their financial practices. The information gathered during internal audits assists professionals in mitigating organizational risks, maintaining control over environments, and improving the effectiveness of strategies. Professional auditors, who assess an organization’s financial records and controls, offer this service. They identify weaknesses in processes and develop plans to streamline the organization’s operations. Professional auditors play a crucial role in helping companies focus on essential areas of their business.

Abdalla Obaid Alshamsi

SAH Perfumes LLC

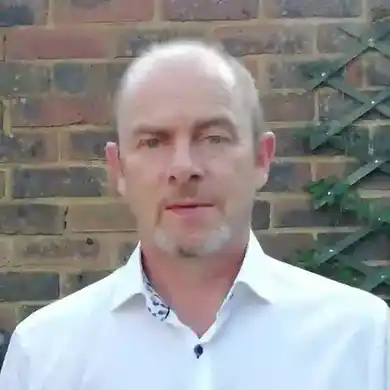

Justin Loach

Oil and Gas Operations Consulting LLC

Kelly Hand

West One Project Management LLC

Jai Verma

Agrizz Global DMCC

Joseph Barron

Outlook Community Management LLC

Mohamad Bachier Khoja

Usha Food Trading L.L.C

Abdi Warsame Mohamed

Al Rawabi Rent A Car L.L.C

John Besterwitch

Meraki Global Solutions FZ LLC

Philip Hand

West One Contracting L.L.C

Majid Hassan Alnaqbi

Majid Alnaqbi General Trading L.L.C