Free Zone Audit Services in the UAE

In the UAE’s diverse economic landscape, free zones offer unique advantages to businesses, including full ownership, tax exemptions, and more. These free zones, spread across all seven emirates, offer unique advantages to foreign investors and businesses. However, businesses in these zones must comply with regulations, including annual audits. Many free zones in the UAE require companies to submit annual audit reports to the respective free zone authorities.

#1 Trusted by Many Free Zone Businesses

Jai Verma

Agrizz Global DMCC

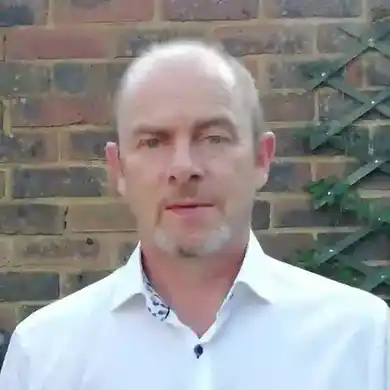

Justin Loach

Oil and Gas Operations Consulting LLC

Kelly Hand

West One Project Management LLC

Abdalla Obaid Alshamsi

SAH Perfumes LLC

Joseph Barron

Outlook Community Management LLC

Mohamad Bachier Khoja

Usha Food Trading L.L.C

Abdi Warsame Mohamed

Al Rawabi Rent A Car L.L.C

John Besterwitch

Meraki Global Solutions FZ LLC

Philip Hand

West One Contracting L.L.C

Majid Hassan Alnaqbi

Majid Alnaqbi General Trading L.L.C

Ensure Compliance with Governing Bodies

Free Zones We Work With

Auditcare: Your Reliable Free Zone Audit Partner

Specialization in Free Zones

Experienced Team

Comprehensive Auditing

Customized Approach

Efficiency and Compliance

Timely Reporting

Our Free Zone Auditing Process

Boost Your Free Zone Compliance

Get in Touch with Us Now to Ensure Seamless Audits in UAE's Free Zones

Understanding Audit Goals

Reasons for Free Zone Audits

- Ensuring Compliance: Audits are conducted to verify that businesses within the free zone are operating in accordance with the rules and regulations set by the respective free zone authority.

- Tax Compliance: Tax authority may audit businesses to confirm that they are correctly calculating, collecting, and remitting taxes, such as Value Added Tax (VAT).

- Financial Transparency: Audits help confirm the accuracy of a company's financial records and reports. It promotes financial transparency, providing stakeholders, including investors and authorities, with a clear and accurate view of a company's financial health.

- Risk Assessment: Audits can identify areas of non-compliance or financial irregularities, reducing the risk of fraud or financial mismanagement.

Submission Deadlines

Typically, free zones mandate companies to submit their audit reports within 90 days of the company’s financial year-end. It’s essential to note that some free zones incorporate this requirement into the trade license renewal process, emphasizing the significance of timely compliance.

While the UAE traditionally follows the calendar year for financial reporting, Dubai free zone companies enjoy flexibility. They have the option to select their financial year, provided it commences from the date of incorporation, spans a minimum of six months, and does not exceed 18 months.

In summary, operating within a UAE free zone offers substantial advantages for businesses seeking international opportunities. However, it’s imperative for businesses to remain cognizant of the regulatory framework, including the requirement for annual audit reports. Auditcare’s audit services are designed to ensure that businesses not only thrive within free zones but also comply with all mandatory obligations, safeguarding their long-term success in this dynamic economic landscape.

Consequences of Non-compliance

Failure to adhere to the requirement of submitting annual audit reports can lead to severe consequences for businesses. These consequences may include substantial penalties and, in some cases, the non-renewal of the company’s trade license. This underscores the critical importance of conducting and submitting annual audits within the stipulated timelines.