goAML Registration - UAE AML Compliance

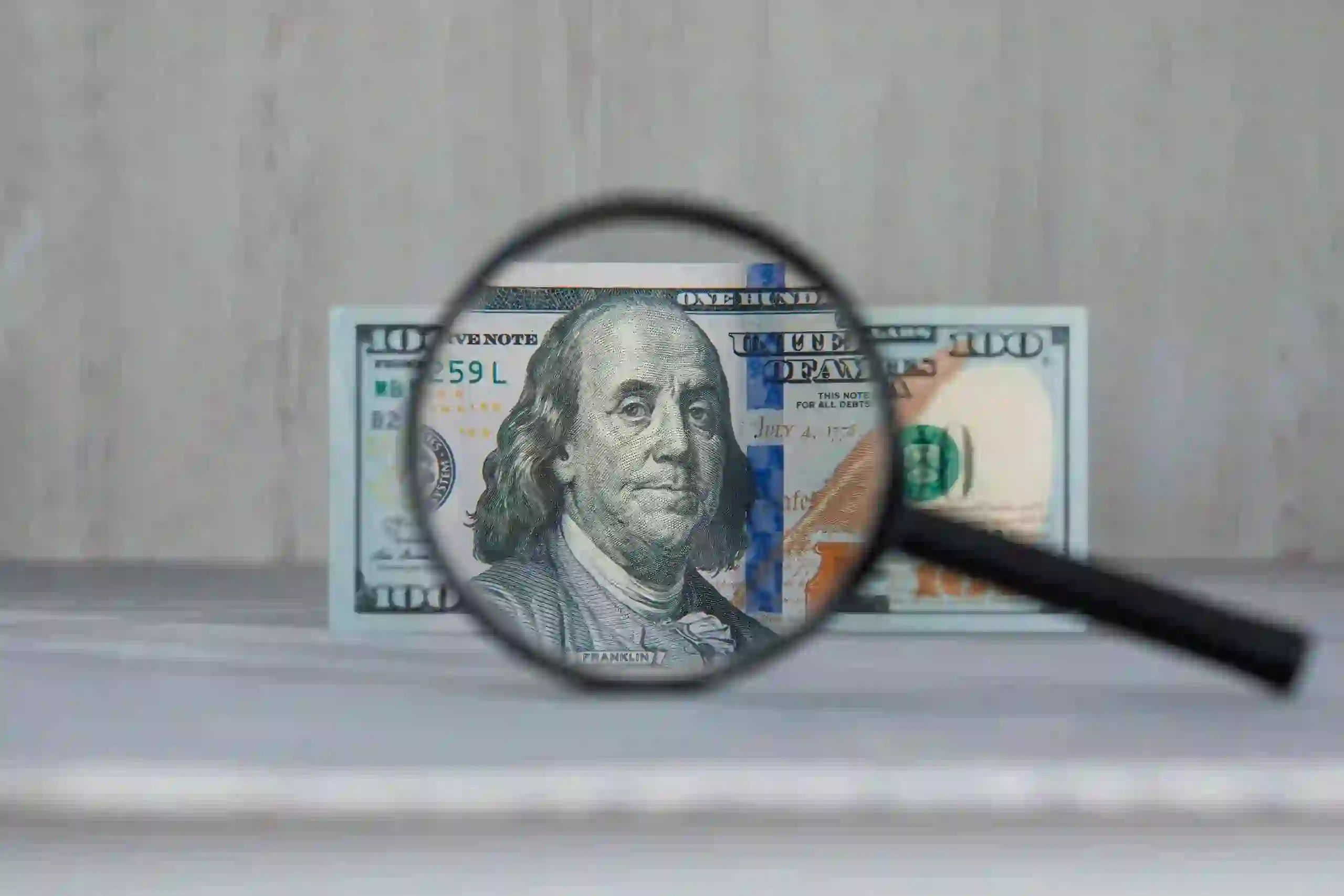

Anti-money laundering (AML) involves legal measures to prevent illegal funds from appearing legal. AML investigations focus on checking financial records for irregularities or suspicious actions. These laws target various crimes, including market manipulation, the trade of illegal goods, corruption of public funds, tax evasion, and the methods used to hide these crimes and their illicit proceeds.

The United Nations Office on Drugs and Crime (UNODC) developed the ‘goAML’ anti-money laundering reporting platform to combat organized crime. All financial entities and Designated Non-Financial Businesses or Professions (DNFBPs) in the UAE are required to register on ‘goAML.’ This platform supports the UAE’s Financial Intelligence Unit in its efforts to combat money laundering, terrorism financing, and other unlawful activities.

Ensure AML Compliance

Who Must Register on goAML?

- Financial Institutions (FIs)

- Brokers and Real Estate Agents

- Dealers of precious metals and precious stones

- Independent Auditors, Accountants and Legal Consultancy Firms

- Independent Corporate Service Providers

Daisy Campos

Luxury Living Real Estate

Joseph Barron

Outlook Community Management LLC

Kelly Hand

West One Project Management LLC

Majid Hassan Alnaqbi

Majid Alnaqbi General Trading L.L.C

Brent Anderson

Gemini Logistics Solutions LLC

Mohamad Bachier Khoja

Usha Food Trading L.L.C

Justin Loach

Oil and Gas Operations Consulting LLC

Mira S.

Amira Jewellery And Piercings FZ LLC

Abdalla Obaid Alshamsi

SAH Perfumes LLC

Alana Prinsloo

Casa Verde Real Estate LLC

Auditcare's Expertise in goAML Compliance

Expertise in UAE Regulations

Efficient Registration Process

Thorough Policy Review

Enhancing Internal Controls

Continuous Regulatory Monitoring

Expert Support

Obligations of Designated Non-Financial Business and Professions (DNFBP)

- Register on the goAML system.

- Identify, assess, and understand risks related to Anti-Money Laundering (AML) and Combating Financing of Terrorism (CFT).

- Define the scope and undertake necessary due diligence measures.

- Appoint an AML/CFT compliance officer approved by the relevant Supervisory Authority.

- Establish adequate management and information systems, internal controls, policies, and procedures to mitigate risks and monitor implementation.

- Implement indicators to identify suspicious transactions.

- Report suspicious activity and cooperate with Competent Authorities.

- Promptly comply with directives from Competent Authorities.

- Maintain adequate records.

Penalties

In the context of Anti-Money Laundering regulations, the Supervisory Authority for DNFBPs may impose administrative penalties for violations of the Decree-Law and its Implementing Regulation. These penalties may include, but are not limited to, financial fines ranging from AED 50,000 to no more than AED 5 million for each violation. Compliance with AML regulations is essential to avoid these penalties and maintain the integrity of financial systems in the UAE.

Required Reports in goAML

The primary reports to be submitted through the goAML platform are Suspicious Transaction Reports (STRs) and Suspicious Activity Reports (SARs). Additionally, there may be instances where Additional Information Files (AIFs) or reports based on Enhanced Customer Due Diligence (ECDD) are required on a case-by-case basis.

Authorities We Work With

Ensure Compliance with Governing Bodies